Knowing what to expect from your utility bills helps you budget effectively and avoid surprises when moving into a new home.

Key Takeaways

- Plan for startup costs like deposits and connection fees, which are common for first-time renters and homeowners alike.

- Compare average utility costs by housing type to benchmark your spending and identify areas where you can reduce usage.

- Adopt eco-conscious habits immediately to lower your monthly bills and reduce your household’s carbon footprint.

Moving into a new place is an exciting milestone, but the logistics of transferring services and managing new expenses can often feel overwhelming. While packing boxes is hard work, navigating the world of deposits, providers, and monthly statements doesn’t have to be stressful or confusing. This guide to Utility Bills 101 covers everything you need to know, from estimating your monthly costs and setting up essential services to implementing smart, energy-saving strategies that keep money in your pocket.

What Are Utility Bills and What Do They Cover?

Utility bills are the recurring monthly statements you receive for the essential services that keep your home functioning, comfortable, and livable. While the specific providers may change depending on where you live, most households deal with a standard set of services. Understanding exactly what you are paying for is the first step toward managing your budget.

Here is a list of common utility bills you will likely encounter:

- Electricity: Powers your lights, appliances, and often your heating or cooling systems.

- Natural Gas: Frequently used for heating, water heaters, and cooking stoves.

- Water and Sewer: Covers the potable water coming into your taps and the wastewater leaving your home.

- Trash and Recycling: Pays for waste collection and disposal services.

- Internet and Cable: Connects your home to the web and entertainment services.

It’s helpful to distinguish between “essential” utilities, like water and electricity, which are necessary for safety and habitability, and “optional” utilities, like cable TV or home security systems. If you are renting, you might wonder about the “utilities included in rent meaning.” This phrase simply means your landlord covers specific costs, often water, trash, or heat, within your monthly rent payment, while you remain responsible for others, like electricity and internet.

Average Utility Cost by Housing Type

Predicting your monthly expenses can be tricky because utility costs vary wildly based on your location, the local climate, and the size of your home. A sprawling house in a hot climate will have a significantly different energy profile than a compact apartment in a temperate region. However, having a baseline estimate helps you build a realistic budget.

The table below outlines estimated monthly costs for common utilities. These figures are estimated ranges based on national trends and data from sources like the U.S. Energy Information Administration (EIA), but they are intended as a baseline guide rather than exact figures for your specific area.

| Utility Type | Average Cost (Apartment) | Average Cost (House) |

|---|---|---|

| Electricity | $60 – $90 | $115 – $160 |

| Natural Gas | $30 – $50 | $60 – $100 |

| Water & Sewer | $30 – $50 | $70 – $90 |

| Internet | $50 – $70 | $60 – $80 |

| Trash & Recycling | $15 – $25 (often included) | $20 – $50 |

| Total Estimated Monthly Cost | $185 – $285 | $325 – $480 |

Note: These ranges are estimates based on national averages and typical usage patterns, and your actual costs may be higher or lower depending on your state and specific energy habits.

When analyzing these numbers, remember that electricity typically represents the largest portion of your utility budget. Climate plays a massive role here; residents in the South often see spikes in summer due to air conditioning, while those in the North pay more in winter for heating. Being aware of these seasonal fluctuations allows you to set aside extra funds during peak months so you aren’t caught off guard.

How to Set Up Utilities in 5 Simple Steps

Knowing how to set up utilities correctly ensures you have lights, water, and heat the moment you walk through the door. If you are looking into utilities for first time renters or homeowners, following this chronological guide will keep the process smooth and organized.

1. List Your Required Services

First, determine exactly which services you need. Check if your new home uses natural gas, electricity, or both for heating and cooking. In some areas with deregulated energy markets, you may have the freedom to choose your specific electricity or gas supplier, giving you the chance to shop around for the best rates.

2. Schedule Service in Advance

We recommend calling providers at least two weeks before your official move date. Utility companies can get backed up, especially at the beginning and end of the month. Waiting until the last minute increases the risk of moving into a dark home or paying expedited service fees.

3. Watch Out for Hidden Utility Costs

Beyond your monthly usage, keep an eye out for “hidden” fees that can catch you off guard. Be prepared for:

- Connection/Activation Fees: One-time charges to start service at a new address.

- Security Deposits: Often required if you have little or no credit history.

- Late Payment Fees: Charges applied if you miss your due date.

- Reconnection Fees: Steep costs to restore service if it was disconnected for non-payment.

Asking about these costs upfront helps you avoid budget shocks on your first bill.

4. Confirm the Start Date

Always set your service start date for the day before you actually move in. This buffer ensures that your refrigerator is cold, your lights turn on, and your internet is ready to go while you are unpacking, rather than waiting for a technician to arrive on a busy moving day.

5. Perform a Move-In Audit

As soon as you arrive, check that all services are working correctly. Locate your meters and check for any running toilets or dripping faucets. You don’t want to be responsible for water or energy wasted by a leak that existed before you arrived.

Learn more about Setting Up Utilities for Your Home

Understanding Your Utility Bill Breakdown

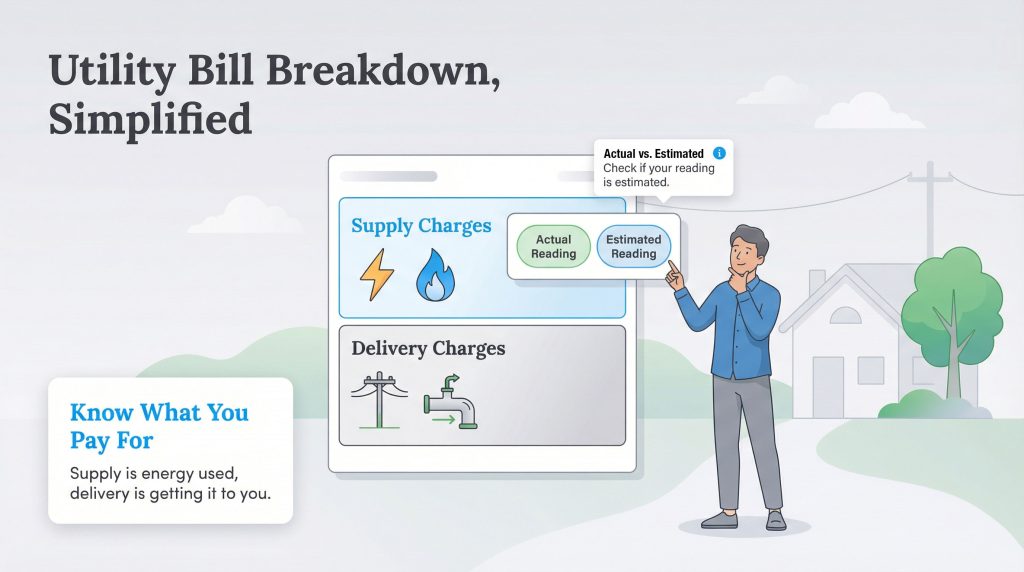

Once your services are running, you will start receiving monthly statements. A common source of confusion is the utility bill breakdown, specifically the difference between supply and delivery charges. “Supply Charges” refer to the cost of the actual energy (electricity or gas) you consumed. “Delivery” or “Distribution Charges” cover the cost of maintaining the power lines, pipes, and infrastructure that bring that energy to your house. Even if you reduce your usage, the delivery fees often remain constant.

You should also pay close attention to the meter reading type listed on your bill. An “Actual” reading means the utility company checked your meter and billed you for exactly what you used. An “Estimated” reading means they guessed your usage based on past history. If they underestimate one month, you might get hit with a large “catch-up” bill the next month once they obtain a real reading.

How to Lower Utility Bills With Eco-Friendly Habits

Learning how to lower utility bills isn’t just about saving money; it’s also about making your home more sustainable. By adopting a few eco-conscious habits, you can significantly reduce your household’s waste and energy consumption.

- Smart Thermostats: These devices learn your schedule and adjust the temperature automatically, ensuring you aren’t heating or cooling an empty house.

- LED Lighting: Swapping out old incandescent bulbs for LEDs uses up to 90% less energy and eliminates the need for frequent replacements.

- Water Conservation: Installing low-flow showerheads and fixing leaks immediately can save thousands of gallons of water per year.

- Unplugging Vampires: Many electronics draw power even when turned off. This “phantom load” accounts for a surprising chunk of your electric bill, so unplug devices or use smart power strips to cut the power completely.

- Go Solar: If you own your home, consider installing solar panels to generate your own clean energy and drastically cut your reliance on the grid.

For more detailed strategies on reducing your power usage, check out our guide on how to save on your electric bill.

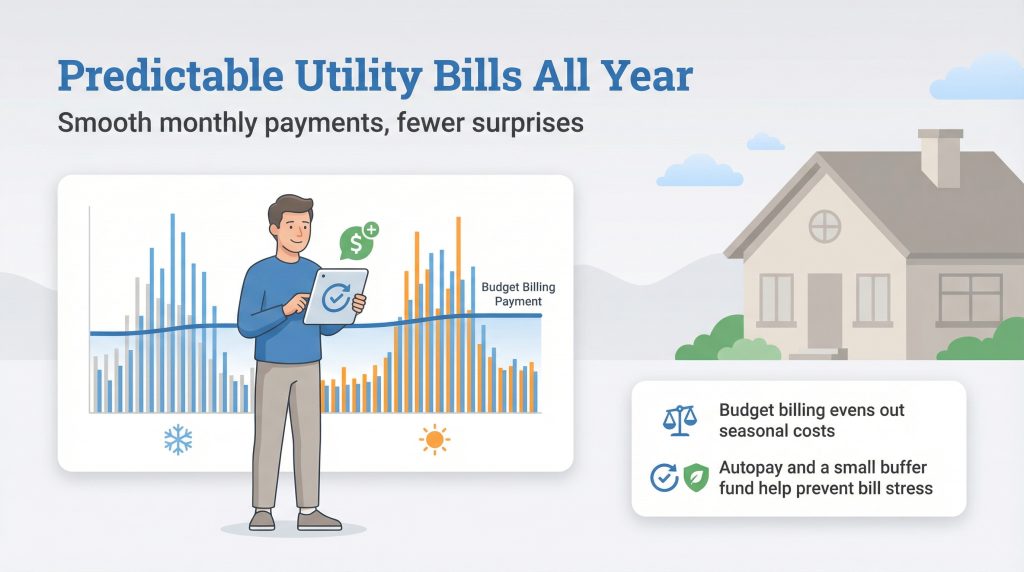

Managing Your Monthly Budget for the Long Haul

To avoid the financial rollercoaster of high winter heating bills or summer cooling spikes, consider signing up for “Budget Billing” with your utility provider. This service, sometimes called levelized billing, averages your estimated annual costs into 12 equal monthly payments. While you still pay for the energy you use over the course of the year, this approach makes monthly budgeting much more predictable and manageable for homeowners.

Experts generally recommend budgeting between 5% and 10% of your annual income for utilities, though this varies by household size. To stay on top of these recurring costs, set up autopay to avoid late fees and consider building a small “utility buffer” fund. Having a little extra cash set aside can be a lifesaver during months with extreme weather, protecting your wallet from unexpected spikes in usage.

Take Control of Your Home Energy Costs

Utility bills are an inevitable part of maintaining a comfortable home, but they don’t have to be a mystery. By understanding what you are paying for, setting up your services correctly, and adopting simple green habits, you can keep your costs down and your stress levels low. Whether you are creating a budget for your first apartment or looking to optimize energy efficiency in a new house, use the steps and data provided here to take charge of your new home’s energy setup with confidence.

FAQs About Utility Bills

What is the average utility bill for a 2-bedroom apartment?

How much should I budget for utilities in my first home?

Do utility bills affect my credit score?

What happens if I forget to pay a utility bill?

Are utilities usually included in rent?

What is the difference between fixed and variable energy rates?

How do I transfer utilities to a new address?

About the Author

LaLeesha has a Masters degree in English and enjoys writing whenever she has the chance. She is passionate about gardening, reducing her carbon footprint, and protecting the environment.