Understanding how solar financing works can save you money and headaches when buying or selling a home.

Key Takeaways

- A Power Purchase Agreement (PPA) is a financial arrangement where a developer installs solar panels on your roof, and you purchase the power they generate at a set rate.

- Unlike owning panels, you do not own the equipment in a PPA, which means you avoid upfront costs but miss out on federal tax incentives like the Solar Investment Tax Credit (ITC).

- If you are moving, transferring a PPA to a new homeowner requires specific credit checks and contract reviews, making it a critical step in the real estate closing process.

Solar energy is becoming a standard feature in modern homes, but the financial contracts behind those shiny panels can be confusing for new buyers and long-time homeowners alike. Whether you’re looking to lower your carbon footprint without a massive down payment or you’re purchasing a home that already has panels installed, understanding the mechanics of these contracts is essential. A Power Purchase Agreement (PPA) offers a unique way to access renewable energy by treating the solar system on your roof like a mini-utility company rather than a home improvement project. In this guide, we’ll break down exactly how these agreements work, how they differ from leasing or buying, and the specific steps you need to take if you’re moving into or out of a home with a solar PPA.

What Is a Power Purchase Agreement (PPA)?

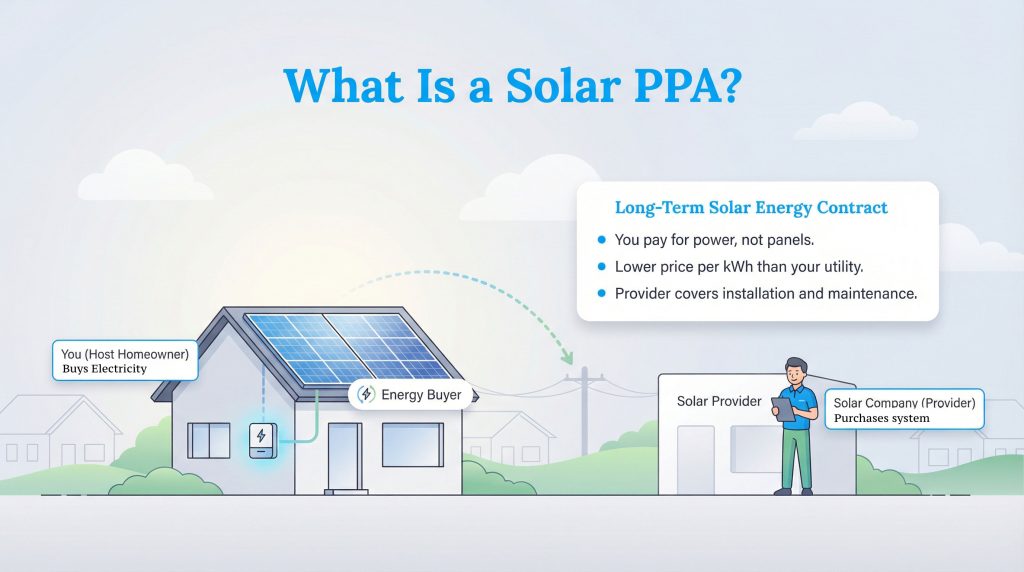

A solar Power Purchase Agreement (PPA) is a third-party ownership model where a solar developer installs, owns, and operates the solar system on your property. In this arrangement, you are the “host,” and the solar company is the “provider.” Instead of paying for the panels themselves, you agree to buy the electricity the system generates, usually at a rate per kilowatt-hour (kWh) that is lower than what your local utility company charges. Think of it as a long-term energy contract or financing vehicle rather than a traditional home improvement project. It essentially places a mini power plant on your roof that sells you energy directly, bypassing the traditional grid for that portion of your usage. Because the developer retains ownership of the equipment, they handle the upfront costs and the ongoing maintenance, making it an accessible entry point into the world of solar energy for many homeowners.

Solar PPA vs. Solar Lease: Understanding the Differences

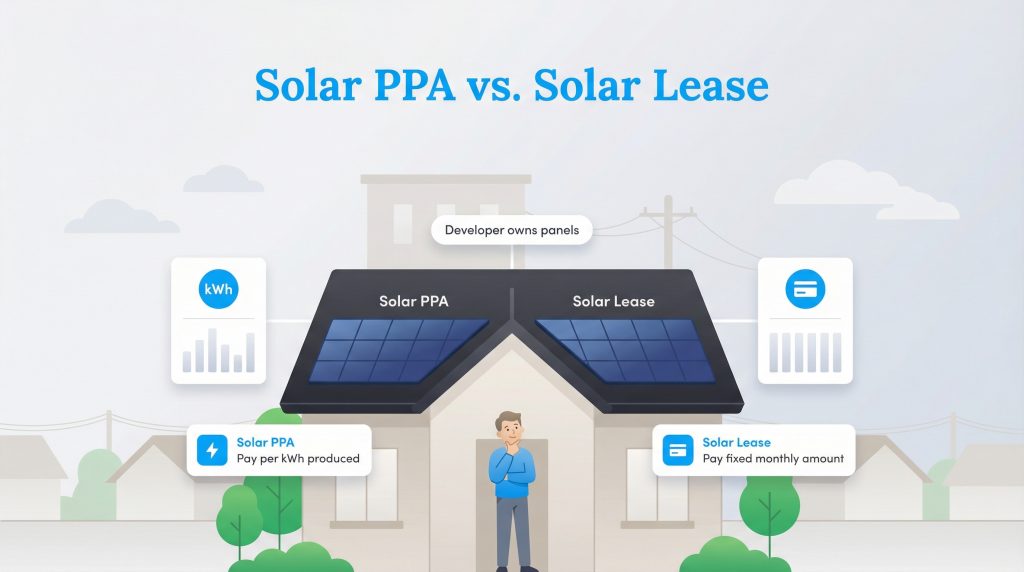

While both PPAs and solar leases allow you to enjoy solar energy without owning the panels, the payment structures are fundamentally different. With a PPA, your monthly bill varies based on how much energy the system produces; you pay a set rate for every kWh generated. If the sun shines more in July, you buy more solar power (and likely less grid power). With a Solar Lease, you pay a fixed monthly rent for the equipment, regardless of how much power it produces. Whether the system generates 100 kWh or 1,000 kWh, your lease payment remains the same.

It’s important to note that in both scenarios, the developer owns the system. This means the developer, not the homeowner, is the one eligible to claim the Federal Solar Investment Tax Credit (ITC). Below is a breakdown of how these options compare to buying a system outright.

| Feature | Power Purchase Agreement (PPA) | Solar Lease | Buying (Cash/Loan) |

|---|---|---|---|

| Ownership | Developer | Developer | Homeowner |

| Upfront Cost | $0 | $0 | High (unless financed) |

| Monthly Payment | Variable (pay per kWh) | Fixed (rent for equipment) | Loan payment (or none if cash) |

| Maintenance | Developer | Developer | Homeowner |

| Tax Incentives (ITC) | Developer Claims | Developer Claims | Homeowner Claims |

The Financial Details: Rates, Escalators, and Savings

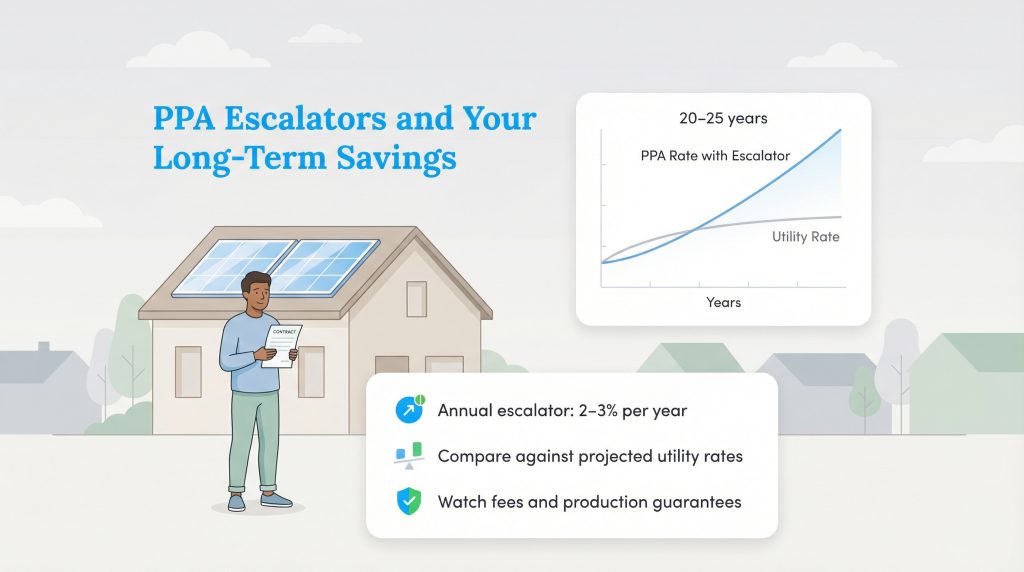

The primary appeal of a PPA is immediate savings. The solar provider sets an initial rate per kWh that is typically lower than your current utility rate. However, these contracts are long-term financial products, often lasting 20 to 25 years, and the fine print matters. A critical component to watch for is the “annual escalator.” This clause allows the solar provider to increase the rate you pay for solar power by a certain percentage, often between 2% and 3%, each year.

The logic behind the escalator is that utility rates generally rise over time, so the solar rate should rise to match. However, if your local utility rates stay flat or rise slower than your PPA escalator, your savings could erode or disappear entirely. You might eventually find yourself paying more for the solar power generated on your roof than you would for power from the grid. We recommend reviewing the escalator clause carefully to ensure the long-term math works in your favor.

Also check for early termination fees, transfer fees if you sell your home, and whether the PPA includes a production guarantee. If the system underperforms and there’s no guarantee, you could end up paying more for less power than you expected.

Buying a House With an Existing PPA

Falling in love with a home that has solar panels can be a bonus, but if those panels are tied to a PPA, you’re inheriting a financial contract along with the house. Before you close the deal, you must perform your due diligence. Ask the seller for a copy of the PPA contract immediately. You need to verify the remaining term length, the current rate per kWh, and the specific buyout terms. Understanding these details will prevent unwanted surprises in your monthly budget after you move in.

Additionally, the solar company will likely require you to pass a credit check before they approve the transfer of the agreement. This is a standard part of the process, but it adds a layer of complexity to the real estate transaction. If you’re preparing for a move, be sure to coordinate with your real estate agent to ensure the PPA transfer is initiated early in the closing process. For more tips on setting up services in a new home, check out our resources on moving and utilities.

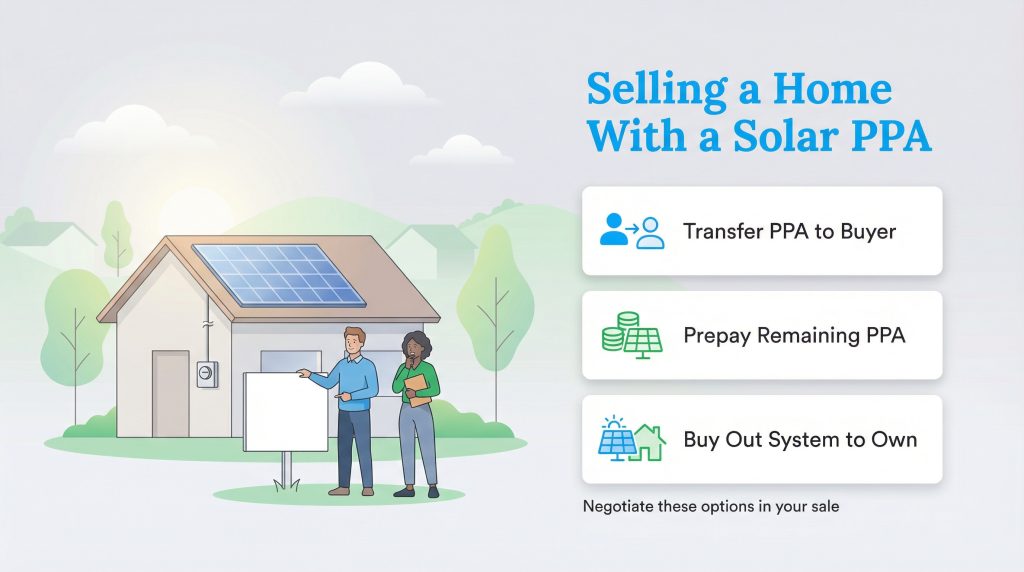

Selling Your Home: How to Transfer or Buy Out a PPA

If you’re selling a home with a PPA, you generally have three options to handle the contract. Not every contract offers all three options, so it’s important to read your specific agreement or call the provider to confirm what’s available. The most common route is to transfer the agreement to the buyer. This allows the new homeowner to step into your shoes, taking over the payments and enjoying the solar energy. However, this is contingent on the buyer agreeing to the terms and passing the solar company’s credit check. Some buyers may be hesitant to take on a long-term contract they didn’t sign up for initially.

Your second option is to prepay the PPA. In this scenario, you pay the estimated cost of the remaining power generation upfront. Prepaying means you’re paying for the future power upfront while the developer still owns the system. The buyer then gets the benefit of the solar system without any monthly payments to the developer for the rest of the contract term, which can be a strong selling point. The third option is to buy out the system entirely. This involves purchasing the equipment from the developer at its fair market value. Once you own the panels, you can include them in the total price of the home, allowing the buyer to own the system outright immediately. Expect to negotiate these options as part of your home sale strategy.

Pros and Cons of Residential Power Purchase Agreements

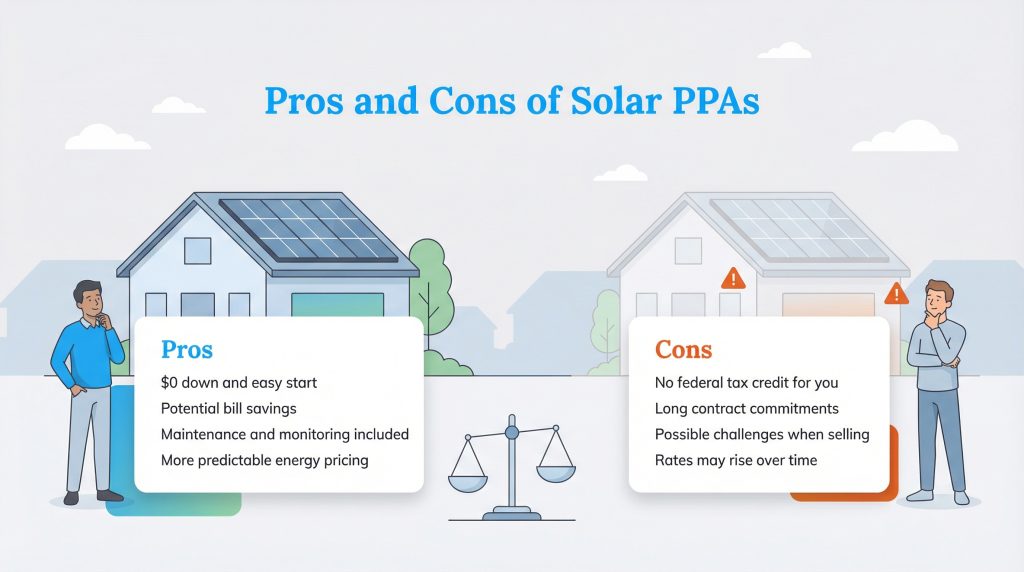

Deciding if a PPA is the right sustainable living choice for you depends on your financial goals and flexibility. Here is a balanced look at the advantages and disadvantages.

Pros:

- $0 Down: Many providers market these as “zero-down solar PPAs,” meaning you can often start using green energy without a large upfront investment.

- Immediate Savings: Rates are typically designed to be lower than your current utility price, but actual savings depend on your local rates and contract details.

- Maintenance Included: The developer handles repairs and monitoring.

- Predictable Pricing: Your contract spells out how your solar rate will change over time, so you can plan for future costs even if rates increase.

Cons:

- No Tax Incentives: You cannot claim the federal tax credit; the developer gets it.

- Long Commitments: Contracts often last 20 to 25 years.

- Selling Complications: Transferring the contract can scare off potential homebuyers.

- Escalator Risk: Annual rate increases could outpace utility inflation.

For more data on solar costs and renewable energy trends, the National Renewable Energy Laboratory (NREL) offers excellent resources and reports.

Making the Right Choice for Your Home Energy

A Power Purchase Agreement is a powerful tool for homeowners who want to support renewable energy and lower their bills without the burden of ownership or maintenance. It removes the barrier of high upfront costs, making solar accessible to a wider audience. Even if you’re mostly focused on monthly bills, PPAs can be an environmentally mindful choice because they help add more renewable energy to the grid without requiring you to own the equipment.

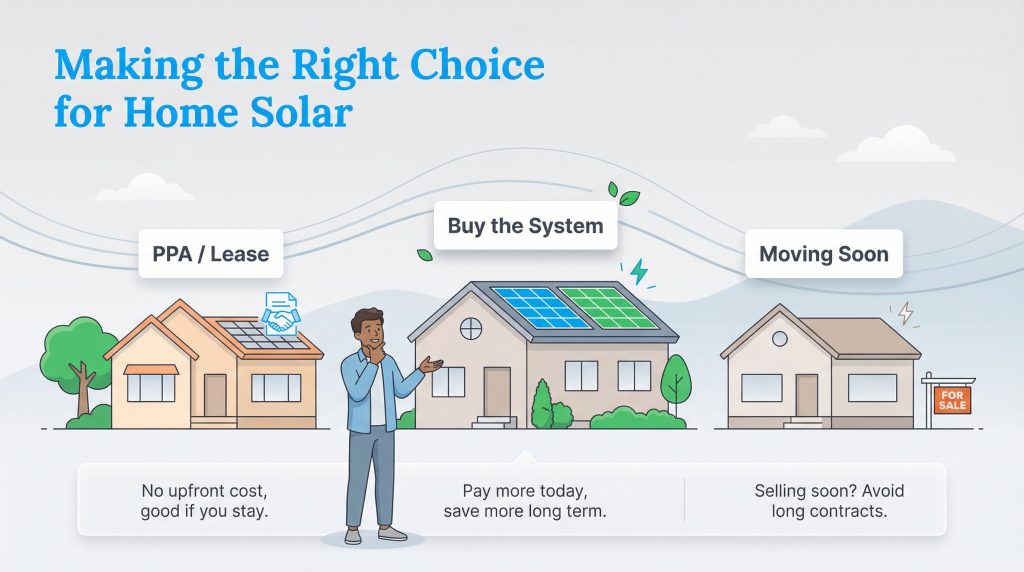

Here is a quick way to think about it:

- If you plan to move within five years, a long-term PPA may not be the best fit unless you’re confident a future buyer will accept the contract.

- If you want solar with no large upfront payment and expect to stay put, a PPA or lease can be a good bridge to clean energy.

- If you can afford the upfront cost and want maximum long-term savings and control, buying the system is usually the strongest financial move.

However, it is not without its complexities, particularly when it comes time to sell your home. If you plan to stay in your house forever and have the capital, buying panels might offer a better return on investment. But for those prioritizing flexibility and immediate savings, a PPA is a viable, eco-conscious option. Just remember to read the fine print—especially regarding transfers and price escalators—before you sign on the dotted line.

FAQs About Power Purchase Agreements

What happens to the solar PPA if I sell my house?

Is a solar PPA better than a solar lease?

Can I get the solar tax credit with a PPA?

Do I still pay my utility company if I have a PPA?

Are solar PPAs available in every state?

About the Author

David has been an integral part of some of the biggest utility sites on the internet, including InMyArea.com, HighSpeedInternet.com, BroadbandNow.com, and U.S. News. He brings over 15 years of experience writing about, compiling and analyzing utility data.