Understanding the difference between buyback plans and net metering to maximize your solar savings.

Key Takeaways

- Solar buyback programs vs. net metering differences dictate whether you get paid at a market rate or credited at the full retail rate for exported energy.

- These programs are most common in deregulated energy markets (like Texas, Ohio, and Pennsylvania), requiring you to shop for specific plans to get the best value for your surplus power.

- Pairing your solar panels with a home battery system can significantly increase your earnings by allowing you to sell power back to the grid when rates are highest.

There are few things more confusing than installing a brand-new solar panel system and still receiving an electric bill the following month. This “bill shock” happens to many homeowners who assume their panels will zero out their costs immediately, only to realize that selling power back to the grid is more complicated than a simple swap. Whether you live in a state with traditional net metering or a deregulated market that uses buyback plans, the rules depend entirely on your location. We are here to help you navigate the fine print, understand how your utility credits you for power, and figure out the best way to make your solar investment pay off.

What Is a Solar Buyback Program?

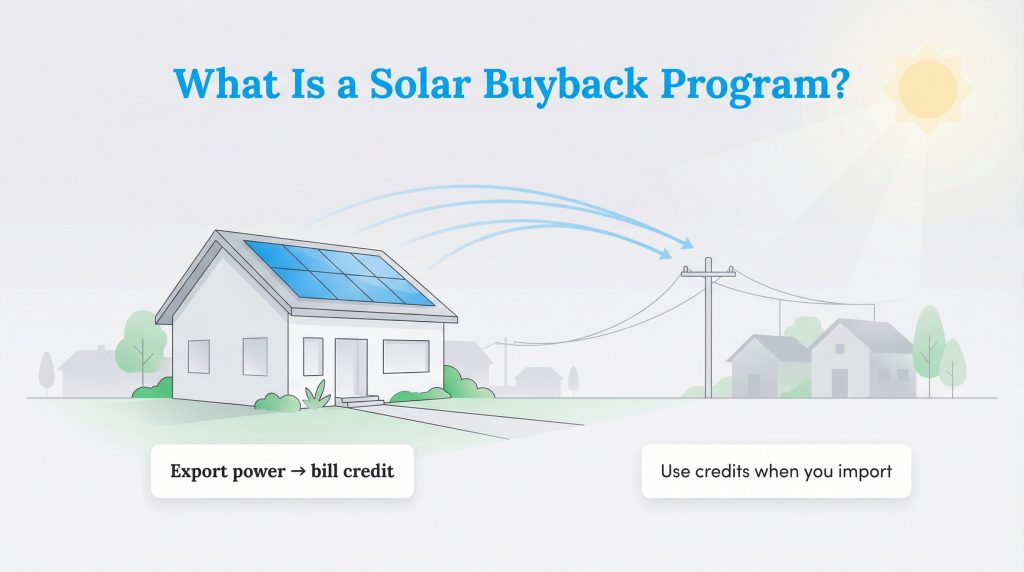

A solar buyback program is an agreement between you and your electric provider where you receive bill credits for the excess electricity your solar panels generate. During the day, your panels often produce more energy than your home can consume. This surplus energy doesn’t just disappear; it flows out from your home and onto the local power grid to be used by your neighbors. In the energy industry, this is called “exporting” power, while buying energy from the grid when the sun goes down is called “importing.”

Think of a solar buyback program like a deposit system on glass bottles. When you return a bottle (export energy), you get a small credit back on your account. However, it is important to understand that this is primarily a financial transaction that results in credits on your monthly utility bill. It is very rare for a utility company to mail you a cash check for your power; instead, they apply bill credits to offset future costs. These credits accumulate to offset the cost of the electricity you import at night or on cloudy days, similar to how “rollover minutes” used to work on old cell phone plans.

Net Metering vs. Solar Buyback: What’s the Difference?

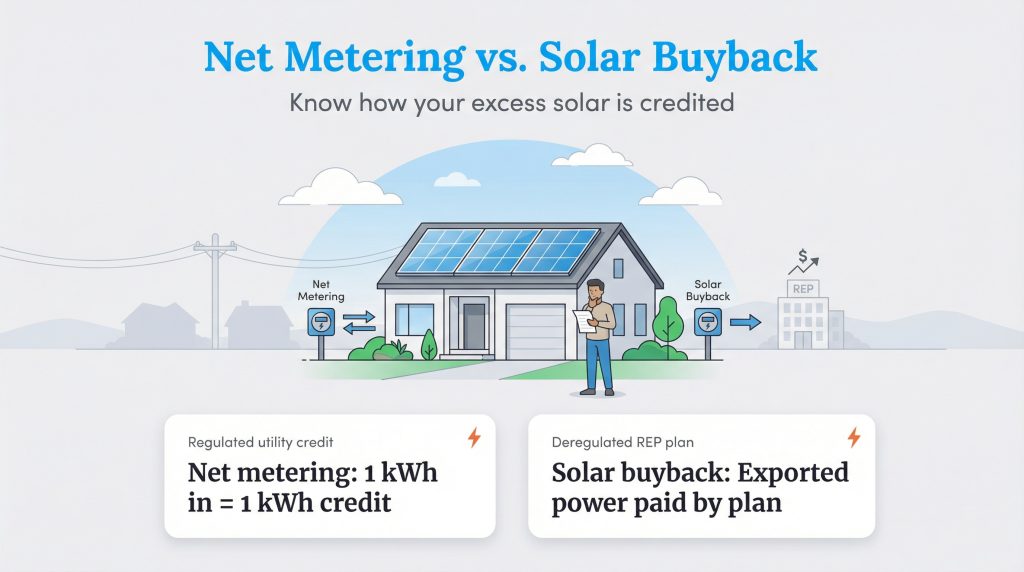

One of the biggest sources of confusion for solar owners is the difference between “net metering” and “solar buyback programs.” While people often use the terms interchangeably, they operate very differently depending on your location. Net metering is typically a policy mandated by state governments in regulated energy markets. Under traditional net metering, the utility is often required to credit you at a 1:1 ratio. This means if you give the grid 1 kilowatt-hour (kWh) of electricity, you get a credit for 1 kWh to use later, effectively using the grid as a free battery.

However, some states are moving from full retail net metering to “net billing” or time-of-use export rates, so your exact credit value depends on your local rules. In contrast, solar buyback programs are common in deregulated markets, such as Texas. Here, the government does not always dictate the price of energy exports. Retail Electric Providers (REPs) create their own buyback rates, which are often lower than the price you pay for electricity. In these markets, the value of your export depends entirely on the specific plan you choose and the current market conditions. For detailed information on incentives and policies in your specific state, the Database of State Incentives for Renewables & Efficiency (DSIRE) is an excellent resource to check. Ultimately, both net metering and buyback programs encourage more efficient use of solar energy, making them an environmentally mindful choice that helps reduce reliance on fossil-fuel generation.

| Feature | Net Metering (Regulated) | Solar Buyback (Deregulated) |

|---|---|---|

| Credit Value | Usually Full Retail Rate (1:1 match) | Wholesale or Market Rate (often lower than retail) |

| Availability | Common in states like CA, NY, FL | Common in deregulated areas like Texas, OH, PA |

| Rollover Rules | Credits often roll over indefinitely | Credits may reset monthly or annually |

Common Types of Solar Buyback Plans

If you live in a deregulated market like Texas, Pennsylvania, or Ohio, you will need to shop for a plan that specifies how you get paid for your power. Not all buyback plans are created equal, and the right choice depends on your lifestyle and risk tolerance.

Fixed-Rate Plans

With a fixed-rate plan, the terms are set in stone for the duration of your contract. You agree to pay a specific rate for the electricity you import, and the provider agrees to pay you a specific rate for the electricity you export. For example, you might pay 14 cents per kWh for usage and receive 10 cents per kWh for exports. These plans offer predictability, making it easier to budget your monthly expenses, though they may not always offer the highest potential financial return.

Real-Time Wholesale Rates

These plans are tied to the actual market price of electricity, which changes every 15 minutes based on supply and demand on the grid. When demand is low, the price might be near zero. However, during a summer heatwave when the grid is stressed, the price for your exported solar power can skyrocket. This structure is high-risk and high-reward. You can earn significant credits during peak times, but you might earn very little during mild weather months.

1:1 Capped Plans

Some providers offer a “1:1” buyback rate that matches your import rate, but with a catch: the credits are capped. This means the provider will match the price for the electricity you send back, but only up to the amount of electricity you consumed that month. If you generate more power than you use, you generally won’t get paid for that extra surplus, or you will be paid at a much lower rate. This prevents you from “banking” huge credits to cover winter months.

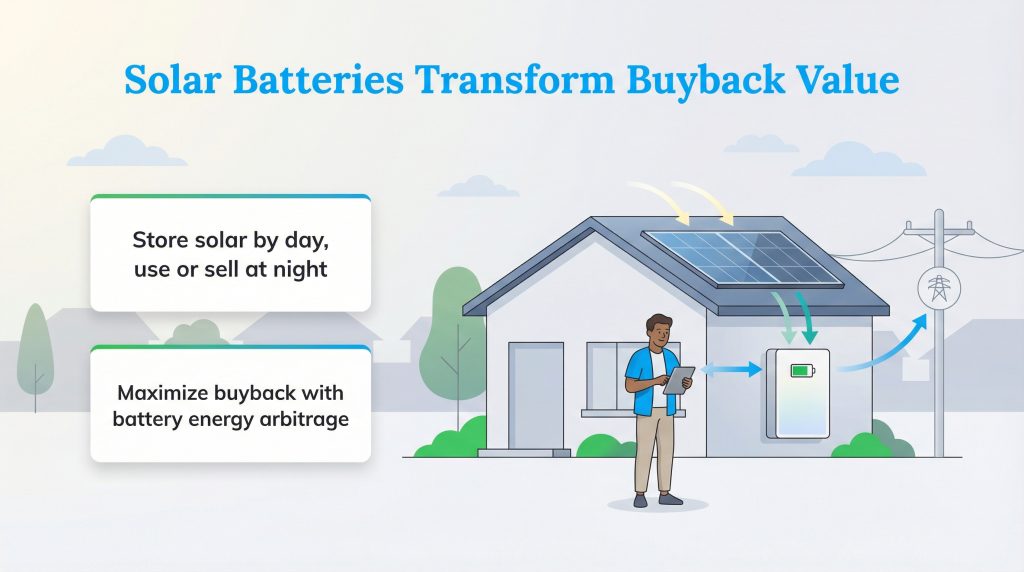

The Role of Solar Batteries in Buyback Plans

Adding a home battery system to your solar setup can completely change the math of solar buyback programs. Without a battery, you are forced to export your excess power the moment it is generated, usually during the middle of the day when rates might be lower. If you have a battery, you can store that solar energy and choose when to use it or sell it. In some programs, you can also send stored battery energy back to the grid to capture high rates, though rules on battery exports vary by provider.

This strategy is known as energy arbitrage. You can store your free solar power during the day and then discharge it to your home or the grid in the evening when electricity prices are highest. By doing this, you avoid buying expensive grid power at night and maximize the value of the energy you sell. Using more of your own solar generation locally is an eco-conscious alternative to drawing from the grid and can help relieve grid stress during peak hours. If you are interested in learning more about how storage integrates with your system, check out our guide to solar energy solutions.

Hidden Costs and Fees to Watch Out For

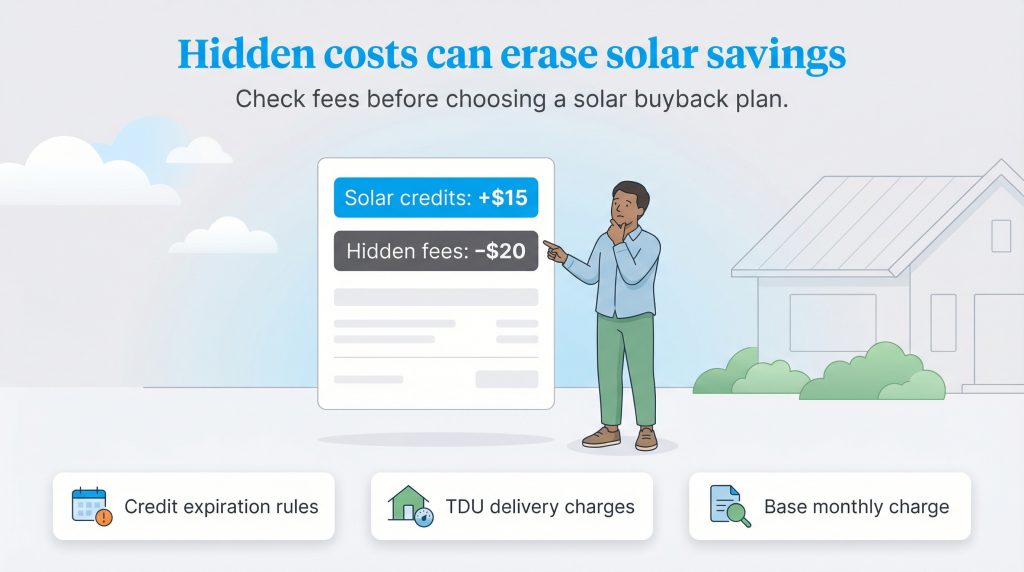

When comparing solar buyback rates, the highest rate isn’t always the winner. Many providers include fees that can eat into your solar savings. It is essential to look at the total cost of ownership rather than just the export rate.

One common “gotcha” is the base charge. Many plans require a monthly subscription fee, sometimes ranging from $10 to $20, just to be on the plan. Even if your solar panels cover 100% of your electricity usage, you will still owe this monthly fee in many markets. If your system is small, this fee alone could wipe out the value of your bill credits. For example, if you earn $15 in credits but pay a $20 base charge, you are effectively losing $5 that month even if your system covers your usage.

You also need to watch out for Transmission and Distribution Utility (TDU) delivery charges. In many areas, you pay delivery fees on every kilowatt-hour you import from the grid. However, you are rarely credited for delivery fees on the power you export. Finally, pay attention to credit expiration rules. Some plans wipe your credit balance clean at the end of the calendar year, meaning any savings you built up for winter could disappear overnight. To learn more about how to minimize these costs, read our tips on how to save on your electric bill.

Always read the Electricity Facts Label (EFL) or contract fine print. Some ‘highest rate’ buyback plans have massive monthly base charges that wipe out your solar earnings.

How to Choose the Right Solar Buyback Program

Finding the right plan takes a little bit of homework, but following a few steps can save you significant money. We generally recommend taking the following approach:

- Check Your Usage: Look at your last 12 months of electricity bills. Compare how much energy you consumed versus how much your system generated. Are you a net exporter (you make more than you use) or a net importer? Net exporters generally benefit from uncapped plans, while net importers should prioritize low import rates.

- Identify Your Market: Confirm if you live in a deregulated zip code. If you do, you have the power to switch providers. If you are in a regulated coop or municipal area, you likely have only one option.

- Compare “True” Value: Don’t just look at the advertised solar buyback rates. Subtract the monthly base fees and factor in the TDU charges to see the real value.

If you need help understanding the basics of switching providers, visit our electric service hub for more guidance. Residents in Texas can also use the official Power to Choose website to compare current offers and view the Electricity Facts Labels for various plans.

Take Control of Your Energy Bill

While navigating solar buyback programs can feel like solving a complex math problem, finding the right plan is the key to maximizing your return on investment in deregulated markets. The “best” plan isn’t the same for everyone; it depends entirely on whether you have batteries, how much power you consume, and when you use it. By taking the time to analyze your usage and read the fine print today, you can ensure that your solar panels generate actual financial savings for years to come. When you match the right plan with your usage patterns, you turn your solar system into both an energy-saving and eco-conscious long-term investment.

FAQs About Solar Buyback Programs

What is the difference between net metering and solar buyback?

Is a solar buyback plan worth it?

Do solar buyback credits roll over?

Can I get a check for my excess solar power?

Who has the best solar buyback program?

Do I still need a solar buyback plan if I have a home battery?

About the Author

LaLeesha has a Masters degree in English and enjoys writing whenever she has the chance. She is passionate about gardening, reducing her carbon footprint, and protecting the environment.