Budget billing smooths out your utility payments to avoid seasonal spikes, but it doesn’t lower your total energy costs.

Key Takeaways

- Budget billing averages your annual energy usage into predictable monthly payments.

- You may still owe a “true-up” balance at the end of the year if you use more energy than estimated.

- Monitoring your actual usage is a smart way to ensure the plan works for your financial goals.

Opening your utility bill during a heatwave or a cold snap can feel like a gamble, with prices often jumping hundreds of dollars higher than you expected. At UtilitiesForMyHome.com, we know that if you live on a fixed income or simply prefer knowing exactly how much money leaves your bank account each month, budget billing offers a solution to that financial roller coaster. While it won’t lower the total amount you pay for energy over the year, it transforms volatile seasonal bills into a steady, flat rate that makes planning your monthly budget significantly easier.

What Is Budget Billing?

Budget billing is a program offered by most electric and natural gas providers designed to level out your utility payments over a 12-month period. Instead of paying for exactly what you use each month, which results in high bills in the summer and winter and low bills in the spring and fall, you pay a fixed average amount every month. It is important to understand that this is strictly a payment strategy for convenience; it is not a discount program, and it does not reduce the rate you pay for energy. You might see this program listed under different names depending on your provider, including “Level Payment Plan,” “Average Monthly Billing,” or “Balanced Billing.” In simple terms, you trade off seeing your exact monthly costs for smoother, more predictable payments. Just remember, predictable payments don’t replace watching your own usage if you want to keep both your bill and your carbon footprint in check.

How Is Budget Billing Calculated?

Utility companies use a fairly straightforward method to determine your monthly payment amount. They want to ensure that by the end of the year, you have paid for exactly the amount of energy you consumed, just in equal installments. Here is the typical step-by-step process many utilities use to calculate that number:

- Review: The utility provider looks at the usage history for your specific address over the previous 12 months. If you are new to the home, they may estimate this based on similar properties or previous tenants.

- Average: They total the cost of that annual usage and divide it by 11 or 12 months to find the monthly average. Some providers also factor in expected changes in energy prices, so your budget amount may reflect both past usage and projected costs. This becomes your set bill amount.

- Adjustment: Providers rarely set this number in stone for the whole year. They review your account periodically, often quarterly, to see if your actual usage is aligning with their estimates. If your usage changes drastically, they may raise or lower the monthly amount to keep you on track.

To visualize how this works, imagine your total annual electric cost is $1,800. Under a standard plan, you might pay $300 in July and only $75 in April. With budget billing, your provider takes that $1,800 total and divides it by 12. Your new bill would be set at $150 per month, every month, regardless of the season. This predictability helps families manage cash flow without fearing the mailbox during peak energy seasons.

The “True-Up” Month: What It Is and How to Prepare

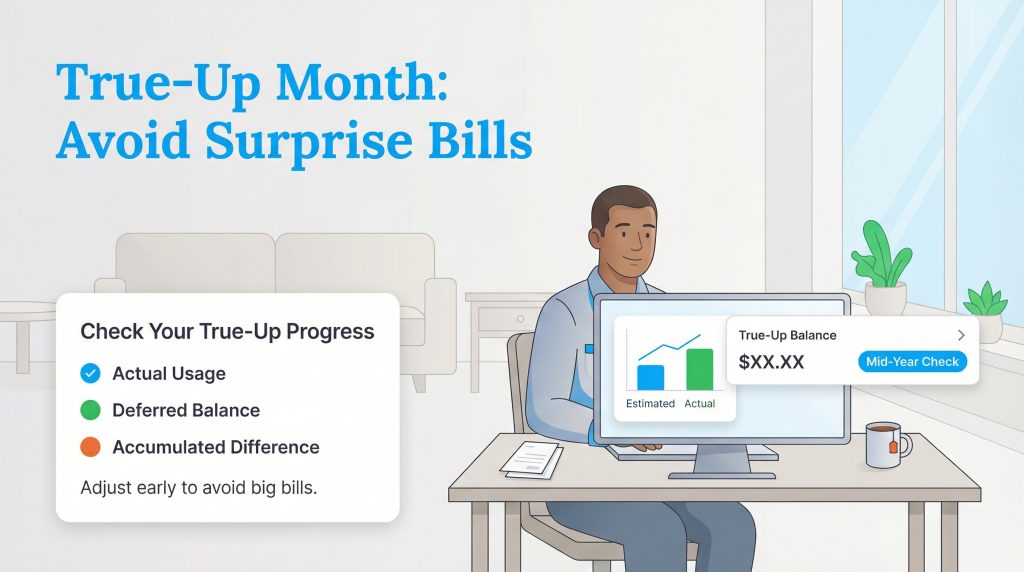

The most confusing aspect of budget billing for many customers is the “true-up” or settlement month. This usually occurs during the 12th month of your billing cycle. Because your monthly payments are based on an estimate, they rarely match your actual usage down to the penny. At the end of the year, the utility company balances the books.

If you used more energy than the company estimated, perhaps due to an exceptionally hot summer, adding a new family member, or buying new electronics, you will owe the difference. This results in a “true-up” bill, which can sometimes be a substantial lump sum. Conversely, if you used less energy than predicted, the utility will credit your account for the overpayment.

To avoid “sticker shock” during your settlement month, you should still open your bill every month. Look for a line item labeled “Actual Usage,” “Deferred Balance,” or “Accumulated Difference.” If you see a negative balance growing, you know you are building up debt that will eventually come due. For strict budgeters, catching this early and making a small adjustment can be much easier than dealing with a surprise lump sum. If you see a growing negative balance by mid-year, you can call your provider to increase your monthly amount a bit now instead of facing one big bill later. If this happens, you can adjust your habits or check out our guide on how to save on your electric bill to bring your usage down before the year ends.

Pros and Cons of Budget Billing

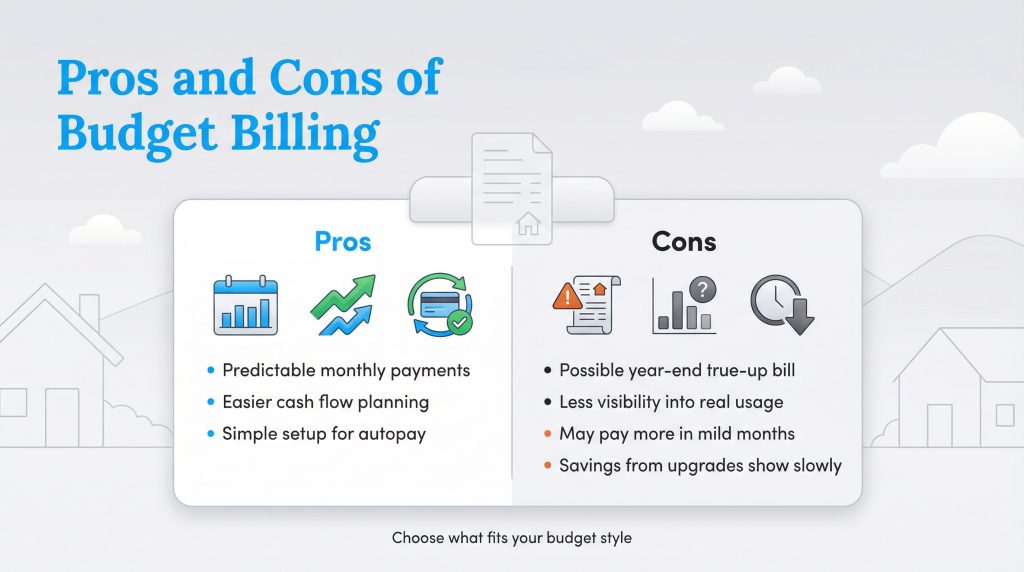

Deciding whether to enroll in budget billing is a matter of financial preference rather than right or wrong. It works beautifully for some households and frustrates others. Here is a balanced look at the advantages and disadvantages to help you decide.

Here are some of the most common pros:

- Predictability: You know exactly what your utility expense will be, making it easier to manage a monthly household budget.

- Cash Flow Management: You avoid the stress of finding extra money during peak winter or summer months when bills traditionally spike.

- Convenience: Automatic payments are easier to set up when the amount doesn’t change from month to month.

However, there are some downsides to consider:

- Settlement Risk: You may face a large, unexpected bill at the end of the year if your usage was underestimated.

- Reduced Awareness: Because your bill stays the same, it is easy to lose track of how much energy you are actually using, which might discourage energy-efficient habits.

- Overpaying Temporarily: During mild spring and autumn months, your budget bill amount will likely be higher than your actual usage costs.

- Lag in Savings: If you significantly cut your usage by adding solar panels or upgrading to efficient systems, it may take a while before your budget amount reflects your lower costs.

Is Budget Billing Worth It for You?

Budget billing is an excellent tool for specific types of residents but can be a hassle for others. It is generally ideal for retirees, people on fixed incomes, or strict budgeters who get anxious about variable costs. If you need your expenses to remain flat to sleep well at night, this program is designed for you.

However, it is likely not the right choice if you plan to move soon or if you are expecting major life changes like a new baby or purchasing an electric vehicle (EV). Closing an account triggers an immediate settlement of any deferred balance, which can be a nasty surprise in the middle of a move. It can also be complicated for roommates who split bills, as tracking who used the energy versus who is paying the average can get messy. Finally, if you are the type of person who wants to “game” the system to save money, this plan won’t help you; you always pay for what you use eventually. In other words, if predictable payments reduce your stress more than seeing exact month-to-month costs, budget billing can be a good fit.

A Smart Alternative: The DIY Energy Savings Fund

If you like the idea of a predictable bill but don’t like the idea of the utility company holding your money, there is a “financial sustainability” alternative. You can create your own budget billing plan. Start by calculating your average monthly cost based on past bills. Instead of paying the utility company a set amount, transfer that average amount into a High-Yield Savings Account (HYSA) every month.

When your utility bill arrives, pay it directly from this dedicated fund. During low-usage months, the fund will grow. During high-usage months, you will have enough saved to cover the spike. The benefit of this DIY approach is that you earn the interest on the extra cash sitting in the account, not the utility provider. This works best if you are disciplined about moving the money every month, even when your current bill is low. To do this effectively, you can research how to estimate appliance energy use on Energy.gov to set a realistic monthly contribution goal.

Make Your Energy Bills Work for You

Budget billing is ultimately a tool for convenience, not a magic trick for savings. Whether you choose to flatten your payments through your provider or manage the fluctuations yourself, the only true way to lower your costs is to use less energy. We recommend combining a consistent payment strategy with eco-conscious habits, like upgrading to ENERGY STAR appliances or sealing air leaks, so you are smoothing payments and actually lowering your long-term costs. Take a moment to compare your last 12 months of bills, your comfort with surprises, and your income stability. Then decide whether a utility-run budget plan or your own DIY fund gives you the right balance of control and peace of mind.

FAQs About Budget Billing

Does budget billing save you money?

What happens if I cancel budget billing?

Why did my budget billing amount go up?

Can I get money back from budget billing?

Is average monthly billing the same as budget billing?

Can budget billing hurt my credit score?

About the Author

LaLeesha has a Masters degree in English and enjoys writing whenever she has the chance. She is passionate about gardening, reducing her carbon footprint, and protecting the environment.