Setting clear expectations and choosing the right split method keeps the peace in a shared apartment

Key Takeaways

- Discuss utility budgets and payment methods before moving in together to avoid future conflicts and surprise costs.

- Consider usage-based splits if one roommate works from home or has significantly higher energy consumption than others.

- Use bill-splitting apps like Splitwise or Venmo to organize expenses and keep a digital paper trail of who paid what.

Moving in with friends or new roommates is an exciting milestone, but the first conversation about finances can instantly bring down the mood. While money talks are often awkward, ignoring them is a recipe for disaster when the first electricity bill lands in your inbox. Many renters assume a simple 50/50 split is the only way to go, but equal doesn’t always mean fair, especially if lifestyles and incomes vary wildly. By establishing a clear system upfront, you can ensure everyone pays their fair share without ruining relationships. This guide will walk you through the best methods, apps, and strategies to handle shared expenses so you can focus on enjoying your new home.

Start the Conversation Before the First Bill Arrives

Timing is everything when it comes to shared finances. The worst time to discuss how to split utility bills in shared apartment setups is after a surprisingly high bill has already been issued. Instead, we recommend having this chat during the lease-signing phase or, at the very latest, on move-in day. By setting ground rules early, you normalize money talk and prevent resentment from building up over time.

During this initial meeting, it helps to create a simple “Roommate Utility Agreement.” You can draft this in a shared note or Google Doc, it doesn’t need to be formal legalese. At a minimum, include who is responsible for each account, exactly how you will split the bills, the household due date, and the protocol for late payments or early move-outs. This adds necessary accountability. This is also the right time to disclose any deal-breakers, such as a need for ultra-fast internet or a preference for keeping the AC at 68 degrees year-round. Getting these preferences out in the open helps you budget accurately and avoid shock when the first statement arrives.

You should also prepare for seasonal fluctuations. Utility costs aren’t static; heating and cooling can cause your bills to jump significantly during extreme summer or winter weather. It helps to ask your landlord for typical seasonal costs or budget a little higher than your average month so you can set realistic expectations.

Choose the Best Method for Splitting Bills

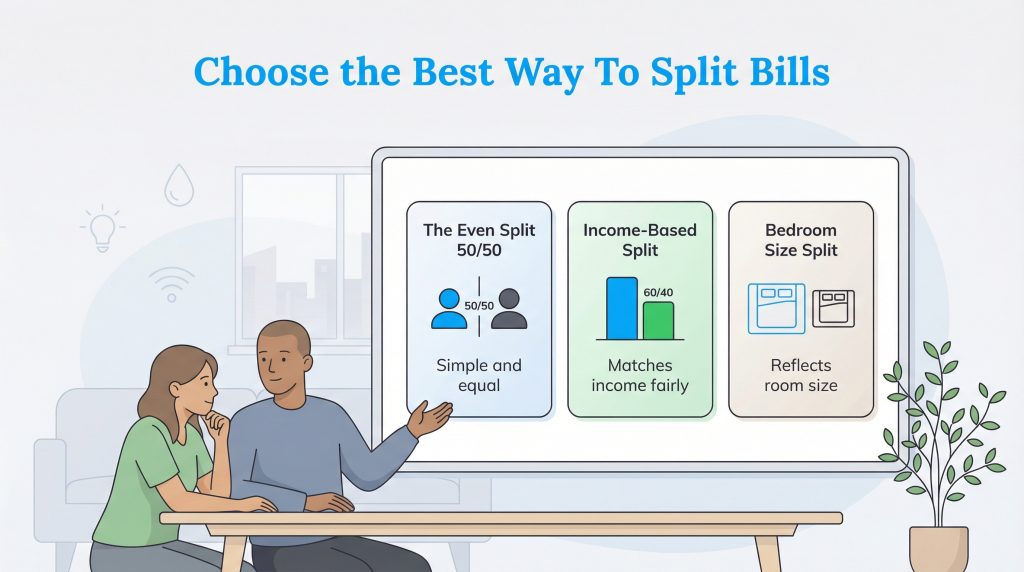

Once you have opened the lines of communication, the next step is agreeing on the math. Determining how to split utility bills in a shared apartment fairly often requires looking beyond a simple even split. While splitting everything down the middle is the default choice, it isn’t always the best fit for every household. Here are three common methods to help you decide what works for your group.

- The Even Split (50/50): This is the most common and simplest method. You take the total amount of the bill and divide it by the number of people living in the apartment. This method works best for roommates who have similar schedules, income levels, and energy usage habits. It requires the least amount of math and eliminates arguments about who left the lights on for five extra minutes. However, it can cause friction if one roommate travels frequently while the other stays home constantly.

- The Income-Based Split: For households with significant wage gaps, an income-based split focuses on equity rather than equality. If one roommate earns significantly more than the other, they might agree to pay a larger percentage of the utilities. For example, if you earn $60,000 and your roommate earns $40,000, you might agree to a 60/40 split. If your monthly electric bill is $100, you would pay $60 and your roommate would pay $40 using that 60/40 split. This approach requires a high level of trust and transparency regarding salaries, but it can make shared living more sustainable for everyone involved.

- The Bedroom Size Split: In many apartments, the rooms aren’t created equal. If one person scores the master suite with a private bathroom and walk-in closet while the others share a smaller room and a hall bath, the person with the better amenities often pays more. While this is commonly applied to rent, you can also apply it to utilities. The logic here is that the person with the larger footprint and private bathroom likely consumes more heat, cooling, and water.

Adjusting for Remote Work and High Usage

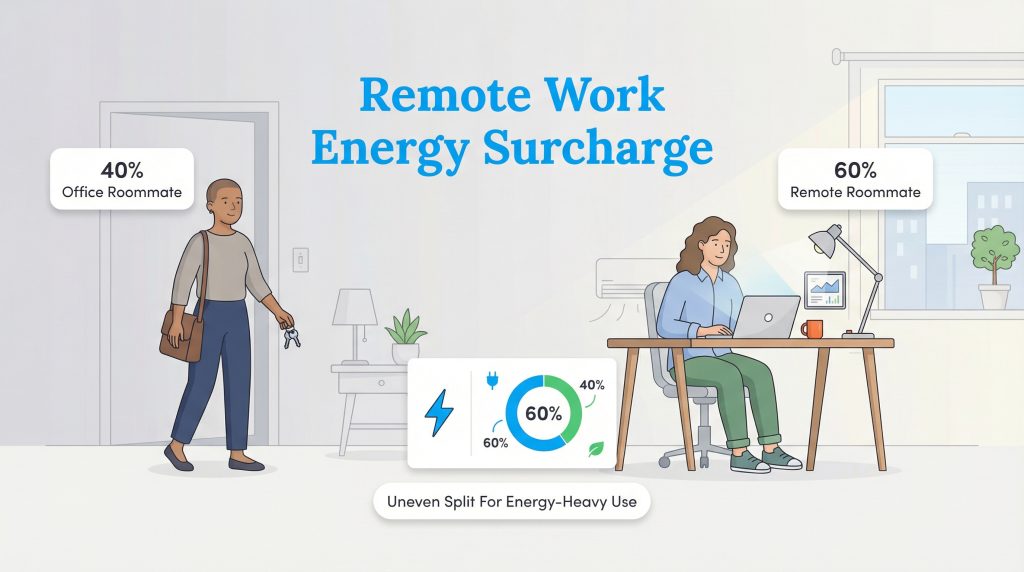

The rise of remote work has introduced a new complication to roommate dynamics: the “work-from-home surcharge.” Splitting bills when one roommate works from home requires a nuance that the old 50/50 rule often misses. If you are in the office from 9 to 5, your energy consumption is minimal during the day. Meanwhile, your roommate who works remotely is running the air conditioning, keeping lights on, using the bathroom, and powering a computer workstation for 40+ hours a week while you are gone.

In this scenario, sticking to an even split can lead to resentment. It is often fair to negotiate a slight adjustment to account for this extra usage. A practical approach is to calculate a “remote work surcharge” for variable bills like electricity and natural gas. You might decide that the remote worker pays 60% of the electric bill while the office worker pays 40%. For instance, if the bill is $120, the remote worker would pay $72 (60%) and the office worker would pay $48 (40%). This acknowledges the extra strain on household resources without requiring you to track every kilowatt. Remember, this usually applies strictly to variable energy costs; fixed costs like internet are typically still shared equally unless the remote worker requires a speed tier upgrade specifically for their job.

Top Apps to Organize and Track Shared Expenses

Trying to manage receipts and mental math is a fast track to conflict. Fortunately, there are several “best apps for splitting bills with roommates” that automate the process, provide transparency, and keep a digital record of every payment. These apps are essential because most utility providers only allow one name on the account, making that single person responsible for collecting money from everyone else.

Splitwise is widely considered the gold standard for tracking shared expenses. It allows you to log bills as they come in and automatically calculates who owes what. It keeps a running total, so you don’t have to swap cash for every $15 charge; you can just settle up at the end of the month. It is best for tracking ongoing shared expenses, while apps like Venmo or CashApp are indispensable for instant, documented payments.

Using these tools is especially important for variable bills. While your internet bill is likely a fixed flat rate every month, electricity and water bills fluctuate. Apps like Splitwise take the guesswork out of these changing costs and send automated reminders so you don’t have to be the “bad guy” nagging for rent money.

Handling Late Payments and Conflict Resolution

Even with the best apps, late payments can happen. The biggest risk in a shared apartment is that the utility account holder is the one legally on the hook. If your roommate doesn’t pay their share, the utility company will come after you, not them. To protect yourself, we recommend setting a household “due date” that is at least 3 to 5 days before the actual utility bill is due. This buffer gives you time to transfer funds and clears the payment before late fees kick in.

If a roommate consistently misses payments, address it immediately. Refer back to your “Roommate Utility Agreement” and have a calm, direct conversation. If the behavior continues, you may need to insist on getting the money before you pay the bill or suggest switching the account into their name for a few months to share the responsibility.

Saving Money Together: The Eco-Conscious Approach

The most effective way to lower your individual share of the utility bill is to lower the total household consumption. Adopting an eco-conscious mindset as a group not only helps the planet but also keeps more money in everyone’s pockets. When you move in, agree on a few simple energy-saving habits that everyone can follow without feeling inconvenienced.

Start with the thermostat. Agreeing to keep the temperature a few degrees higher in summer and lower in winter can shave a significant percentage off your monthly costs. In common areas, ensure you are using LED light bulbs, which use at least 75% less energy than incandescent lighting according to Energy.gov. Another major energy drain is laundry; agree to only run the washer and dryer when you have full loads, and use cold water whenever possible. If you want to dive deeper into efficiency, you can read more about how to save on your electric bill with smart usage tweaks.

Why Communication Keeps Your Shared Home Running Smoothly

Splitting utilities doesn’t have to be a source of stress or awkwardness. While math equations and apps are helpful tools, open and honest communication is the real secret to a happy home. By setting clear expectations early, choosing a fair split method, and respecting each other’s financial situations, you can prevent conflicts before they start. Remember to revisit these rules if your living situation changes, such as a new partner moving in or a job change, to ensure the arrangement stays fair for everyone.

FAQs About Splitting Utility Bills

What is the fairest way to split utilities?

How do you split bills when one person works from home?

Is it better to put utilities in everyone’s name?

Can you split utilities based on income?

What usually counts as a shared utility bill?

About the Author

LaLeesha has a Masters degree in English and enjoys writing whenever she has the chance. She is passionate about gardening, reducing her carbon footprint, and protecting the environment.