Understanding how MUDs fund infrastructure and impact your monthly costs is essential for homebuyers in developing areas.

Key Takeaways

- Municipal Utility Districts (MUDs) are special political subdivisions that finance water, sewage, and other infrastructure in areas where city services aren’t yet available.

- MUD taxes are an additional line item on your property tax bill used to pay off the bonds that funded the community’s development, though these rates often decrease over time.

- While often confused with HOAs, MUDs are government entities with the power to levy taxes, whereas HOAs are private organizations that enforce deed restrictions and collect fees.

If you are house hunting in a new development or a suburb just outside city limits, you might have paused when scanning a property listing and seen a reference to a “MUD Tax.” It’s a common point of confusion for many buyers who are used to standard city utility bills. While the acronym might sound messy, a Municipal Utility District is actually a highly organized way to bring modern conveniences like running water, sewage systems, and parks to communities that local cities can’t reach yet. Think of it as the financial engine that makes your new neighborhood habitable and comfortable before the city catches up.

What Is a Municipal Utility District (MUD)?

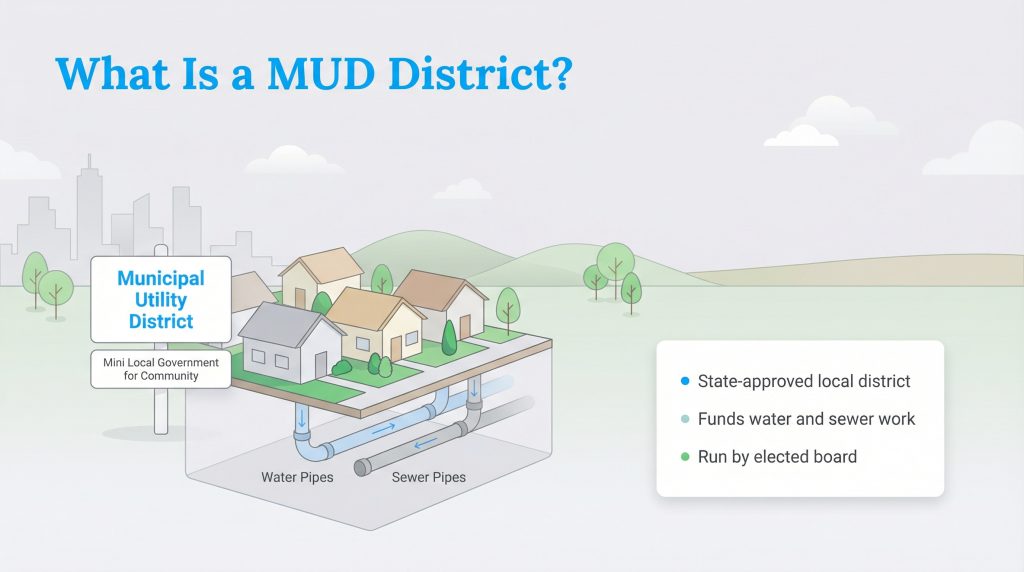

A Municipal Utility District, or MUD, is a political subdivision authorized by the state to provide infrastructure and services to areas not served by a municipality. While MUDs are most prevalent in Texas, similar “special purpose districts” exist across the United States to bridge the gap between rural land and developed communities, though the exact structure and powers of these districts can vary by state.

These districts exist because city infrastructure, like water and sewer lines, doesn’t always extend to new developments right away. Cities often lack the funds or the immediate reach to lay pipes in every new subdivision springing up on the outskirts. To solve this, developers request the creation of a MUD. This allows them to sell bonds to finance the construction of water, sewer, and drainage systems.

A Board of Directors, usually elected by property owners within the district, governs the MUD. In Texas and many other states, they manage the budget, set tax rates, and ensure the systems run smoothly. Effectively, when you live in a MUD, you are receiving your services from a mini-local government dedicated solely to your community’s water and infrastructure needs.

How MUD Taxes Work (The Money Part for Homebuyers)

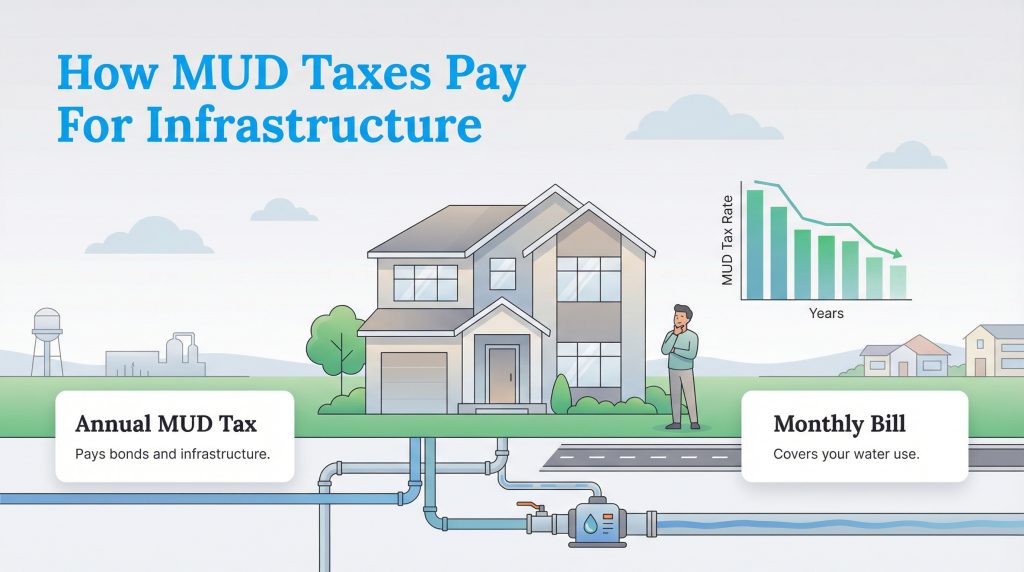

The financial structure of a MUD is often the biggest concern for potential homeowners. To pay for the massive upfront cost of installing underground pipes, treatment plants, and roads, the MUD issues bonds. These bonds are essentially loans that must be paid back over time with interest.

Residents within the district pay off this debt through property taxes. This means you will see a specific MUD tax rate on your annual property tax bill, calculated based on your home’s assessed value. It is important to distinguish this from your monthly utility bill. You will still receive a monthly bill for the actual water and sewage usage you consume, just like you would in the city. The annual tax covers the infrastructure debt and operations, while the monthly bill covers your household consumption.

The good news is that in many districts, MUD tax rates follow a downward trend. In the early years of a development, rates are generally higher to service the significant debt required to build everything from scratch. As the community builds out and more homes are sold, the tax base expands. With more homeowners sharing the burden, and as the principal debt is paid down, the tax rate often decreases, although tax rates can stay flat or even increase if the district issues new bonds or operating costs rise.

MUD vs. HOA vs. City Utilities: What’s the Difference?

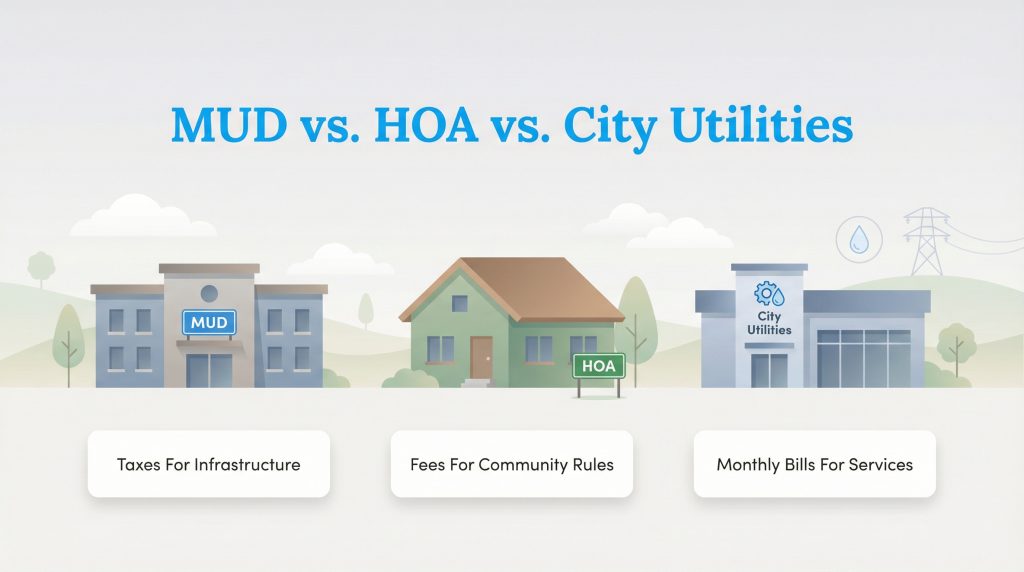

It is easy to conflate a MUD with a Homeowners Association (HOA), especially since both involve fees and community management. However, the distinction is legally significant. A MUD is a public, government entity, while an HOA is a private corporation.

Because a MUD is a government body, it has the authority to levy taxes. If you fail to pay your MUD taxes, the district can foreclose on your home in the same manner as the county would for unpaid property taxes. An HOA, on the other hand, collects dues (fees) to maintain common areas and enforce deed restrictions regarding aesthetics, like paint colors or lawn maintenance. While an HOA can place a lien on your property for unpaid dues, they do not have the same taxation powers as a MUD.

Here is a quick breakdown to help you keep them straight:

| Feature | Municipal Utility District (MUD) | Homeowners Association (HOA) | City Utility (Standard) |

|---|---|---|---|

| Primary Purpose | Infrastructure (water, sewer, drainage) | Community aesthetics and rules | Infrastructure and public services |

| Funding Source | Property taxes & monthly utility charges | Private membership dues/fees | Property taxes & monthly bills |

| Governance | Elected Board of Directors (Government) | Elected Board of Directors (Private) | City Council / Municipal Govt |

| Tax Deductible? | Generally yes (as property taxes) (Talk to a tax professional about your specific situation.) | Generally no | Generally yes (as property taxes) |

Living in a MUD: Services, Amenities, and Eco-Impact

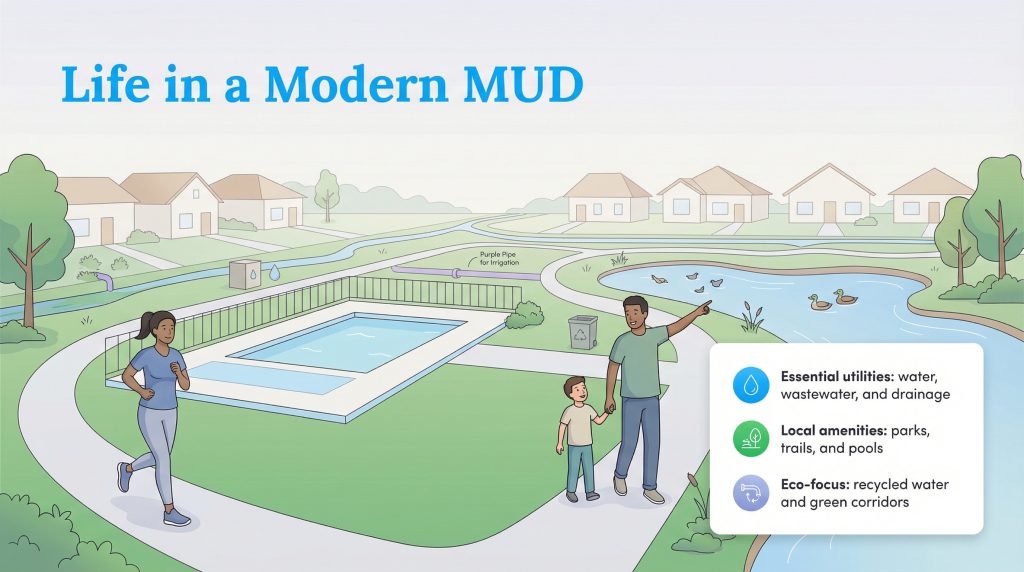

Living in a MUD provides the essential services required for modern living, including water, wastewater treatment, and drainage. Many districts also manage solid waste (trash and recycling) collection. Without these districts, development in many desirable suburban areas would be impossible.

Beyond the basics, MUDs often fund the amenities that make a neighborhood enjoyable. The parks, jogging trails, and community pools you see in master-planned communities are frequently financed and maintained by the MUD. This means the taxes you pay are directly reinvested into the quality of life within your immediate surroundings.

Modern MUDs are also increasingly focusing on sustainability. An increasing number of districts now utilize “purple pipe” systems, which recycle treated wastewater for irrigation in parks and common areas. This reduces the strain on fresh drinking water supplies. Additionally, MUDs often maintain green drainage corridors and retention ponds that manage stormwater runoff in an eco-conscious way, preventing flooding while creating habitats for local wildlife.

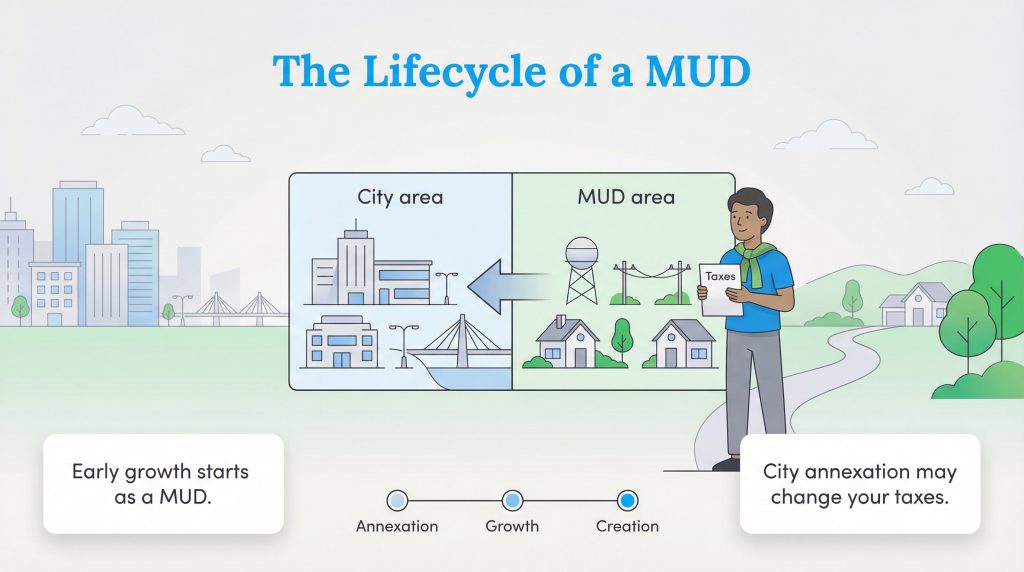

The Lifecycle of a MUD: From Creation to Annexation

In many regions, especially around growing cities, a Municipal Utility District is designed as a vehicle for early growth that may eventually transition into full city service. The long-term goal for many districts, particularly those near expanding urban centers, is annexation. As a city grows outward, it may choose to annex a MUD, effectively absorbing the district into the city limits.

When annexation occurs, the city usually takes over responsibility for services and assumes the district’s remaining debt. In most cases, the separate MUD tax line disappears and is replaced with the city’s standard property tax rate. Depending on that rate, your overall tax bill may go up or down. However, this transition is not overnight. The process can take decades, so you should not purchase a home in a MUD banking on immediate annexation. It is a slow, regulated evolution that happens only when it makes financial and logistical sense for the city.

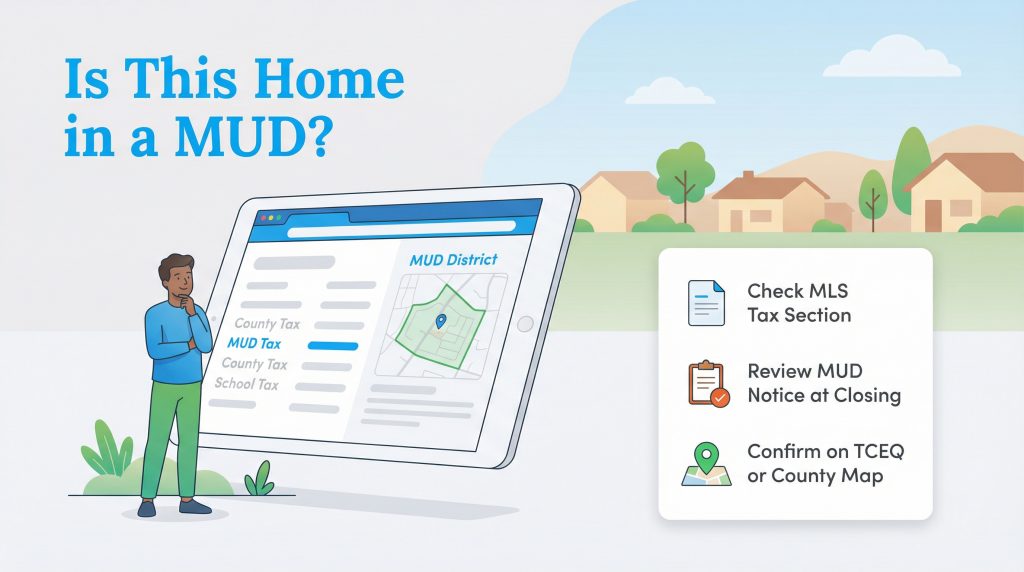

How to Find Out If a Home Is in a MUD

Determining if a potential home is located within a MUD is straightforward if you know where to look. Most real estate listings on the Multiple Listing Service (MLS) will disclose this information in the tax section. You will likely see a separate taxing entity listed alongside the school district and county taxes.

In states like Texas, where MUDs are ubiquitous, consumer protection laws are strict. Sellers are legally required to provide a “Notice to Purchasers” form before closing. This document details the district’s bonding authority and the current tax rate, ensuring you aren’t blindsided by the costs. For a proactive check, you can visit the Texas Commission on Environmental Quality (TCEQ) or your local county appraisal district’s website, which typically hosts maps and tax data for specific addresses.

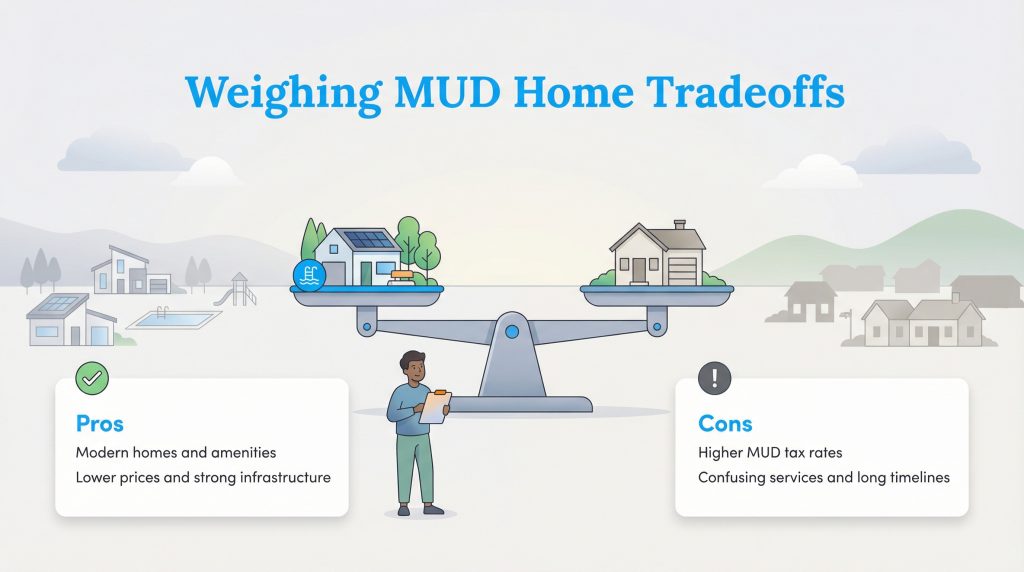

Weighing the Pros and Cons of Buying in a MUD

Deciding to buy a home in a MUD involves balancing immediate costs against lifestyle benefits. To help you decide, here is a quick look at the advantages and disadvantages:

Pros:

- Access to modern homes and amenities in brand-new communities.

- High-quality infrastructure like pools, parks, and trails often funded by the district.

- Potentially lower home purchase prices compared to established city centers.

Cons:

- Higher overall tax rate due to the additional MUD levy.

- Confusion between MUD taxes and standard city services.

- Uncertainty regarding future annexation timelines.

On the positive side, MUDs allow you to buy modern homes in brand-new communities that might otherwise be undeveloped land. You get access to high-quality infrastructure and amenities like swimming pools and expansive parks that older city neighborhoods might lack. For many families, the affordability of homes in these developing areas outweighs the tax costs.

However, the financial commitment is real. The initial tax burden is often higher than in established city neighborhoods, and navigating the separation between MUD taxes and city services can be confusing. Utility rates may also vary compared to municipal rates. When you are planning a move, it is vital to calculate the total monthly payment, mortgage plus all property taxes, to see if the MUD premium fits your budget.

Smart Planning for Your Future Home

Understanding the nuances of a Municipal Utility District empowers you to make a confident decision without fear of hidden costs. While the extra tax line item might seem daunting at first, it is the trade-off for high-quality utilities and community perks in a growing area. By verifying the tax rates upfront and reviewing the district’s long-term plans, we can help you understand exactly where your money is going and how it benefits your daily life and the long-term health of your community.

FAQs About Municipal Utility Districts

Do MUD taxes ever go away?

Can a MUD foreclose on my home?

Is living in a MUD more expensive than living in the city?

Can a neighborhood have both a MUD and an HOA?

Who sets the water rates in a MUD?

How do I know if I am in a MUD in Texas?

About the Author

David has been an integral part of some of the biggest utility sites on the internet, including InMyArea.com, HighSpeedInternet.com, BroadbandNow.com, and U.S. News. He brings over 15 years of experience writing about, compiling and analyzing utility data.